Why Building Booms And Assessed Tax Value Simply Won't Provide The Growth We Need...

Realities About Accessed Values.

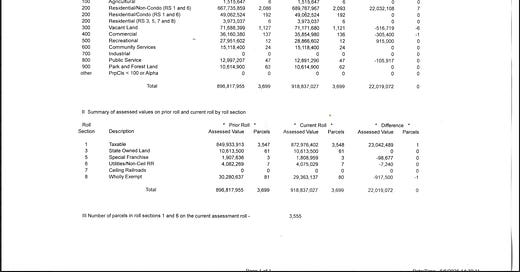

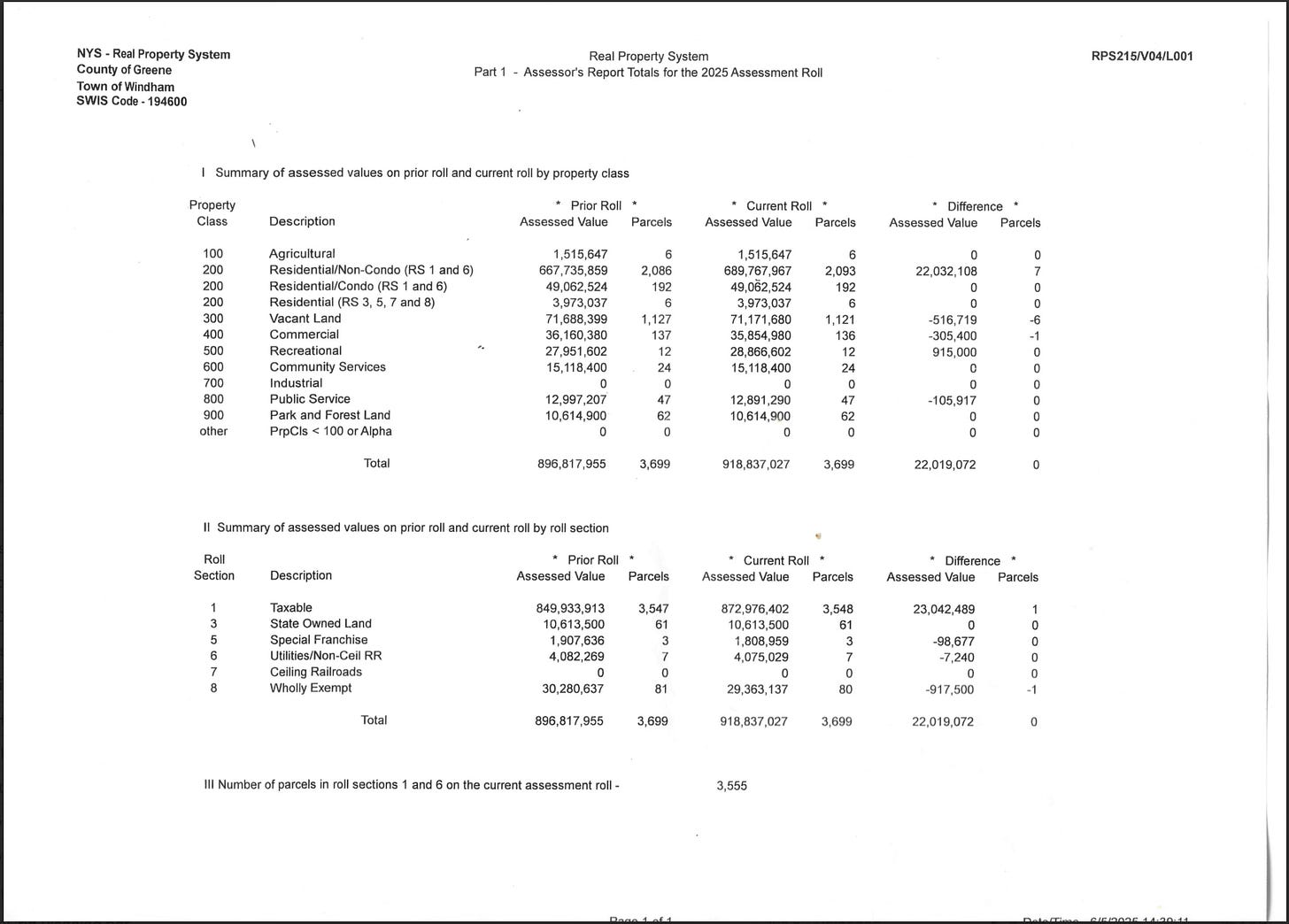

So, as you look at this report, it should jump out at you that the majority of Windham’s housing wealth is tied up in single-unit residential homes that aren’t condos. 2,092 parcels make up this category with a value of $689+ million. For Windham to have more than half a billion dollars in value in these types of homes alone tells us that our community is on a building spree that cannot be sustained indefinitely. At no time can our job market support the continuation of this type of building. Let’s put this way, if we had to build this same type of tax base on properties with an assessed tax value of $205,000, it would require 3,361 homes roughly. That’s nearly a thousand more homes than were reported to exist in 2020, with 2,385.

There seems to be a bit of a discrepancy between the Real Property System reports for 2025 and the data reported by the Town of Windham. Our supervisor has reported that $24 million in new assessed value was generated in our community in 2025. The reality is slightly less, according to this assessor’s report, which shows clearly that only $22,019,072.00 was generated in new value. And even more disappointing is the fact that this accessed value only shows a total of 7 new parcels of land being added to our tax rolls. That would mean each of these new homes has an average tax value of $3.146 million? Possible, but not very likely. It makes more sense that what we’re seeing here is the general rise in property values across the board for many homes in the community.

A little more mathematics will tell us an important feature of the added $22.092 million of assessed value. While this multimillion-dollar figure sounds impressive at first glance, a deeper look shows a far less impressive figure for actual tax base development. The fact is, when one calculates at the actual taxation rate of 2.712837% [2025’s actual town tax rate for Windham], the total tax increase is only $59,932.19. That is all that comes out of the $22.092 million increase in assessed tax for the town. That is an extremely small sum relative to the overall amount of $22.092 million that the community has grown in its tax base. And yet we plunge headlong into the trend of creating tax value in this manner.

And this trend is going to continue for some time in our community if the Town Board refuses to offer anything more than the Status Quo when it comes to economic development in our community. For example, right now we’re seeing the development of 3 major projects in Windham:

Windham Skye is a 30-home private residential development on County Route 10.

Windham Lyssy Development 5 residential properties on Mill St.

Elau is an upscale Cabin Development with 4 Cabins, roughly 2500 sq Ft on Mitchell Hollow Road.

As you can see, the oversized housing development bandwagon is still in high gear in our community. Even though these homes will probably become more of the vacant homes that dot our landscape so predominantly. The real tragedy is that even their much vaunted property value increases will translate to very small gains in our community’s tax base. Let’s take the first development, “Windham Skye,” a 30-home residential property development. Let’s assume for this example that each lot has a tax assessed value of $1.5 million (a relatively high value to make my point). A little quick math gives us $45 million in value added to the tax base. That makes for an excellent headline in the local newspaper, which might read “Building Boom Adds $45 Million To Tax Base!” But if we are still taxing at say 2.712837% per $1000 in value, then $45 million becomes $45,000 x 2.712837% equals $122,077.00. Not so impressive really when one considers the big picture.

We are seeing in most of the developments the creation of new septic systems and new wells being drilled. It is not out of the realm of possibility that our limited water resources will be compromised in this process. And then that $122,077.00 in increased taxbase doesn’t seem like such a great investment if we require millions in water filtration, pumping, and distribution infrastructure, not to mention storage systems. And this doesn’t even account for economic leakages.

The question of economic leakage becomes the next big factor to consider. While our community might have gained 30 new homes in the example above, we’ve lost millions in growth potential. The facts are incontrovertible in this regard; the economic leakage from these projects will far outweigh the tax revenue and the few jobs they represent. For example, the Windham Skye Project is certain to have non-local contractors building the bulk of this project. These projects always do. That represents millions of revenue spent that never actually touches our community. For example, remember that Wylder Hotels in Windham used Baxter Construction and LCS facility Services to do a majority of their work— two companies I worked with at the Culinary Institute of America and other job sites around Poughkeepsie. The only semi-local contractor was Stoneridge Electric out of Cairo. Expect to see more and more of this with these development projects. These companies that do major developments aren’t going to create long-term growth in our community. That is because they are going to move on to the next community that offers the next big value.

What all too often happens is that when one of these big projects becomes untenable, you’re left with unfinished developments. For example, the Stonewall Glen project that was supposed to be completed by 2023 (2022 originally) is now 2 years overdue and still unfinished. What was supposed to be 59 units ended up being 12 units; now they remain in various states of completion. According to tax records, 8 of these units have been purchased mostly by LLCs. This same fate is certain to hit more of our hopeful developers looking to cash in on the “Windham Experience”, but failing to realize that the market is slowing down. Part of the reason why the market is slowing has to do with rising costs of Skiing at Windham Mountain Club and the reduction in the number of ski passes from 7,000 to 8,000 passes on a weekend to 4,000 to 4,500 passes sold. The gravy train of this type of tourism is coming to an abrupt end with climate change, exclusivity of the skiing experiences, and the migration of the local population under the age of 45 will only accelerate a collapse.

However, this fate can be avoided. One of our best ways to avoid this fate is to simply divert some of the expenses we are already spending in non-local economies back into Windham’s economy. For example, instead of buying plants at Lowe’s or Home Depot in Catskill, make those same purchases at the Catskill Mountain Country Store or other local places. If 1200 members of our community spend just $150.00 of their monthly budget in local establishments instead of in Catskill or Hudson, that translates to $180,000 per month in local spending. If that occurs for 12 months, this will equal an expansion of the local economy of $2.16 million before any multiplier effect takes place. This is money we are already spending in the general economy. The question becomes, why not channel more of it into our local economy?

As Town Supervisor, I am going to push hard to develop a SHARE Program with our local commercial banks. This is a program where a bank will set up special accounts for checking and savings accounts that are designed to support local investments. Here is how it will work— you set up a new Checking Account and Savings account the Bank X. They ask if you would like to be part of the SHARE program, and you accept. The bank will then only use your funds to support investments in local businesses in the community. Perhaps, someone needs a new Steel Building for their growing Lawn Mowing Business. The SHARE Program would provide that money for an investment like this. If the commercial banks refuse to work with our community, then we can explore other types of financial institutions, including developing our own Town-Owned Bank.

As can be seen from my simple example, even just small changes in local economics can yield vast returns for our community. When these changes are coupled with a local government that is focused on Local First initiatives, we will see real economic growth in our community. Merely selling off our community to develop more vacant homes in the hopes that an increase in our tax base will yield the growth we need is not realistic.

A new vision is required.